Apartment rentals across Cavite have become a rising choice for landowners and investors looking to turn idle properties into income-generating assets. With Metro Manila becoming increasingly congested—both in population and economic competition—more people are moving southward. Cavite is seeing a growing demand in the rental market as urban sprawl and accessibility make it a top choice for relocation and business.

But just how profitable is it to build a rental apartment in Cavite? In this article, we break down real market numbers, sample construction costs, and projected income returns to help you make a confident, ROI-driven decision.

Dasmariñas City, Cavite

(Photo credits to City Planning & Dev’t. Office – Dasmariñas )

Market Profile:

As Cavite’s largest city and an educational hub, Dasmariñas boasts a steady influx of students, workers, and young families. Its blend of universities, commercial centers, and subdivisions creates constant rental activity.

• Diverse tenant pool: students, young professionals, and families

• High rental demand due to universities and proximity to Metro Manila

• Lot prices range from ₱12,000–₱30,000 per sqm depending on location

• Stable returns, low vacancy rate

• Best for: balanced risk-takers, passive investors

Rental Demand:

High for 1BR units (especially 18–25 sqm), commonly rented by students, BPO workers, and small families. 2BR and 3BR options also have stable demand in suburban pockets.

Lot Price:

₱10,000–₱20,000 per sqm in most barangays; prices go higher near Pala-Pala, Salitran, and key road networks.

Investment Risk:

Low to moderate. High tenant turnover ensures steady occupancy, and mid-range land/build costs make it attractive for ROI-focused projects.

Best for:

Investors looking for fast ROI with 1BR apartments, or balanced multi-unit projects in a high-foot traffic environment.

Dasma’s central location and thriving university belt make it one of the most vibrant rental markets in Cavite. Despite higher land costs in prime areas, the steady stream of students and working professionals keeps demand consistently high, making it an ideal location for multi-unit apartments with good turnover.

Bacoor City, Cavite

Market Profile:

Bacoor is Cavite’s gateway to Metro Manila, making it a hotbed for commuters and professionals. It’s a highly urbanized city with established subdivisions and mid-to-high income residents.

• Strong rental competition due to its closeness to Metro Manila

• High turnover but high rental potential

• Lot prices range from ₱20,000–₱45,000 per sqm

• Slightly higher investment risk

• Best for: seasoned investors, furnished unit strategies

Rental Demand:

High, especially for 2BR units and semi-furnished townhomes. Renters here are often small families or professionals who work in Manila but prefer Cavite’s cost of living.

Lot Price:

₱18,000–₱35,000 per sqm depending on barangay and proximity to major roads like Molino Blvd and Aguinaldo Highway.

Investment Risk:

Moderate to high. While rental rates are premium, land and construction costs are significantly higher. Returns are solid, but require bigger upfront capital.

Best for:

Mid-level to high-capital investors targeting long-term tenants and stable income in an urban residential market.

Its rental landscape reflects both opportunity and saturation—making it essential to understand which layout strategies work best before investing. For those considering Bacoor City, maximizing returns may mean targeting furnished units, flexible leasing terms, or higher-end amenities to stand out in the competitive market.

Imus City, Cavite

(Photo credits: City Government of Imus)

Market Profile:

A rapidly growing city with a mix of developing communities and commercial hubs. It serves both working-class families and young professionals.

• Popular among starter families and working professionals

• Solid demand with access to transport routes

• Lot prices range from ₱14,000–₱28,000 per sqm

• Steady ROI with manageable property upkeep

• Best for: landowners with smaller lots wanting flexible unit types

Rental Demand:

Steady for both 1BR and 3BR units. Imus sees a diverse renter profile — from students and couples to larger families in need of affordable space.

Lot Price:

₱12,000–₱25,000 per sqm, with prices rising near district centers like Anabu and Buhay na Tubig.

Investment Risk:

Low to moderate. Balanced construction and land costs make Imus a safer choice for beginner and intermediate investors.

Best for:

Investors who want steady ROI with flexibility — from low-cost units to larger rental homes for families.

Imus strikes a healthy balance between accessibility and affordability, making it one of Cavite’s more stable cities for rental ventures. The area caters to mid-income tenants seeking long-term housing, especially near commercial and transit hubs.

Tanza, Cavite

Market Profile:

Tanza is a fast-developing area with suburban character, attracting both low- to middle-income families. Many housing developments are sprouting, especially near the Tanza-Trece Martires highway.

• Emerging market with affordable entry points

• Growing demand for rentals from locals and nearby workers

• Lot prices range from ₱8,000–₱15,000 per sqm

• Low-risk, long-term potential

• Best for: entry-level investors or retirees wanting passive income

Rental Demand:

Strong for 1BR and small 2BR units (20–30 sqm). Tenants are often local workers, small families, or those relocating from more congested areas.

Lot Price:

₱8,000–₱15,000 per sqm, making it one of the most affordable locations in Cavite for residential investments.

Investment Risk:

Low. With low land acquisition and construction costs, Tanza offers fast ROI and minimal entry barriers — though rental rates are lower compared to inner cities.

Best for:

Budget-conscious investors or landowners looking to generate passive income from smaller, practical units.

Tanza offers one of the lowest barriers to entry in Cavite’s rental property scene. With its expanding local workforce and infrastructure upgrades, this town presents promising cash flow opportunities for those starting out in real estate investing—especially outside Metro Manila.

General Trias, Cavite

(Photo credits: City Government of General Trias).

Market Profile:

General Trias is a booming mixed-use city with industrial parks, subdivisions, and commercial zones. It’s a rising favorite for OFW families and professionals.

• Family-oriented rentals and OFW landlords

• Increasing demand due to suburban expansion and new infrastructure

• Lot prices range from ₱10,000–₱20,000 per sqm

• Moderate risk, growing development

• Best for: long-term income planning, compound property strategies

Rental Demand:

Broad — from high-demand 1BR units in subdivisions to larger 3–4BR homes in village-style neighborhoods. Short-term and long-term leases are both active.

Lot Price:

₱10,000–₱20,000 per sqm, with some village lots going higher depending on amenities and access to key roads.

Investment Risk:

Moderate. Land and building costs are reasonable, but success depends on matching unit types to location (subdivision vs highway-access lots).

Best for:

Flexible investors seeking mixed rental types — ideal for both low-mid cost 1BR apartments and higher-end family rentals.

With the rise of new townships, industrial parks, and road expansions, General Trias is becoming a strategic hub for rental property investments. Its balanced market of family tenants and OFW-owned units presents both stability and room for future value growth—making it ideal for mid-size rental apartments that benefit from Cavite’s long-term urbanization.

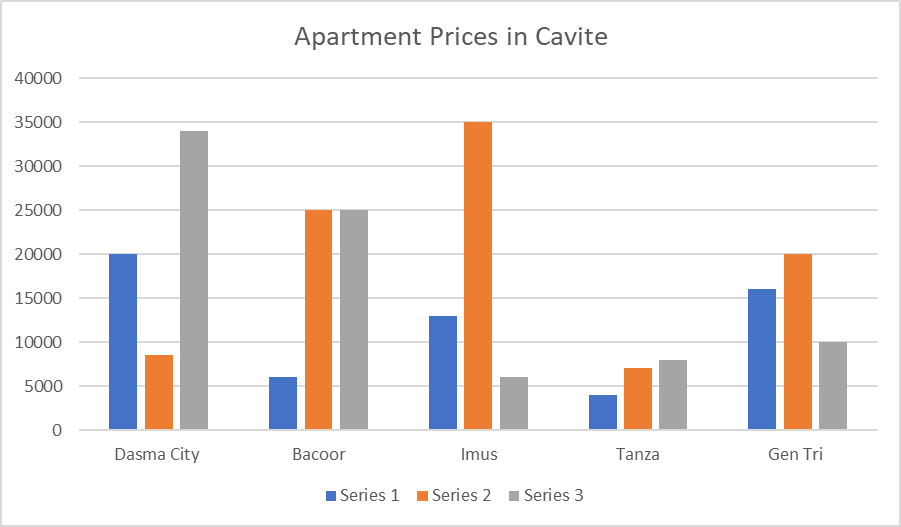

Sample Rental Rates Table

Here is a raw data regarding monthly rates for each apartment depending on the city they are in.

The most expensive monthly rates is Imus City and Dasmariñas City who are both highly urbanized area with many corporate and academic opportunities. The least expensive is Tanza—an underdeveloped place which would be seen to be have a potential high rates once the General Trias City, Cavite have achieved the major projects that opens more economic growth.

In addition, due to anticipated developmental plan, real estate brokers tend to show the potential economic opportunities of General Trias City to be the most dominating place among Cavite region. It is expected that the prices for each apartments for it outgrown the surrounding places especially those of which in the higher price today.

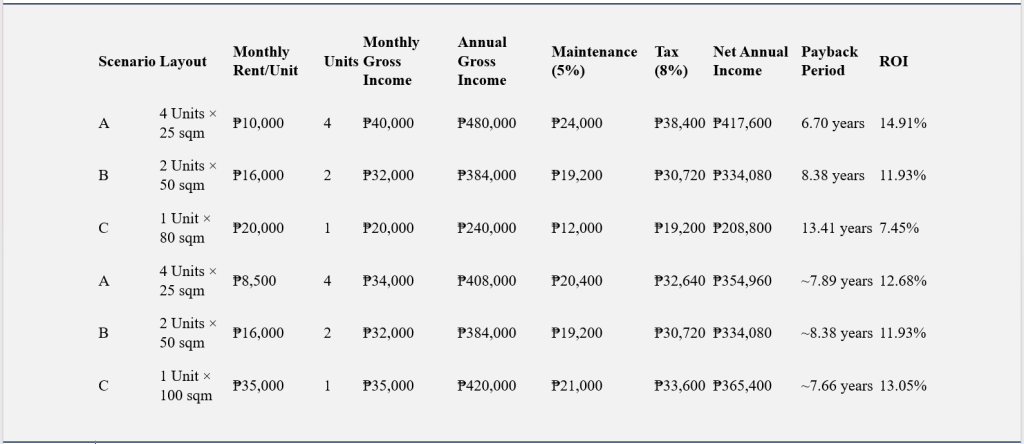

Real-time Apartment Prices and its ROI

These calculations reveal that smaller units generally offer faster ROI due to higher per sqm income. However, the single large unit model can also be favorable in high-rent areas with lower vacancy risk.

What This Means for Investors

If you’re considering building an apartment outside Metro Manila, Cavite offers a solid balance of affordability and earning potential. Among the configurations studied, 25 to 50 sqm units deliver some of the most competitive ROI percentages while minimizing upfront risks. While smaller units offer quicker returns, larger units—especially those in prime areas like General Trias—can attract higher-end renters and more stable income.

The takeaway? Your land’s location, target market, and property layout will all impact your return. But with the right strategy, even a modest 100 sqm build can yield sustainable cash flow.

Would you like us to compute more detailed ROI based on your land size or preferred rental setup? Let us help you unlock the potential of your property.

At C. Escudero Engineering Services, we specialize in building income-generating properties tailored to your goals and location. We’ve built a lot of apartments before.

From lot assessment to construction and cost planning, we guide you every step of the way—so you can invest with clarity and confidence.

Build smart. Earn steady. ROI you can see.

Leave a comment